Discover the 2025 visa-free entry options for Indian citizens visiting the Philippines—14 and 30-day stays with AJACSSUK privilege. Explore the booming digital nomad visa, tax-free expat living, and why the Philippines is emerging as Asia’s top tropical tax haven and outsourcing hub.

Table of Contents

-

Introduction: Why Philippines Is Trending in 2025

-

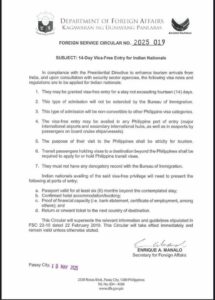

Visa-Free Entry for Indian Citizens – Explained

-

Requirements for 14-Day Visa-Free Entry

-

Who Qualifies for 30-Day AJACSSUK Visa-Free Entry?

-

Philippines: A Tropical Tax Haven for Expats

-

Upcoming Digital Nomad Visa in 2025

-

Best Visa Types for Long-Term Stay

-

Business and Investment Opportunities in the Philippines

-

English Proficiency and Cultural Compatibility

-

Top Expat Hotspots: Island Life and More

-

Cost of Living: How Affordable is the Philippines?

-

Taxation Breakdown: How Foreigners Avoid Global Taxation

-

Why the Philippines is the Next Big Thing for Indian Professionals

-

Challenges to Be Aware Of

-

Is the Philippines Right for You?

1. Introduction: Why the Philippines Is Trending in 2025

In 2025, the Philippines is rapidly emerging as one of the top international destinations for Indian tourists, remote workers, digital nomads, and investors. With the introduction of visa-free entry for Indian passport holders, the country is extending a warm welcome to travelers and entrepreneurs alike.

But that’s just the tip of the iceberg. Here’s why it’s gaining popularity:

-

New 14 & 30-day visa-free travel options for Indian citizens

-

Upcoming Digital Nomad Visa with tax incentives

-

0% income tax on foreign income for qualifying non-residents

-

A tropical lifestyle with low cost of living and high English fluency

-

Increasing foreign investment opportunities

2. Visa-Free Entry for Indian Citizens – Explained

Indian nationals now have access to two categories of visa-free entry to the Philippines:

✅ 14-Day Visa-Free Entry

Open to all Indian passport holders who meet specific entry conditions.

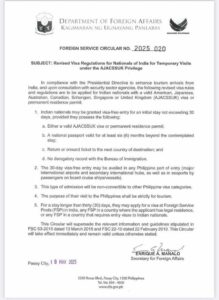

✅ 30-Day Visa-Free Entry (AJACSSUK Privilege)

Granted to Indian nationals who hold valid visas or permanent residency in countries under the AJACSSUK group:

-

Australia (A)

-

Japan (J)

-

America / USA (A)

-

Canada (C)

-

Schengen Area (S)

-

Singapore (S)

-

United Kingdom (UK)

3. Requirements for 14-Day Visa-Free Entry

To qualify for 14-day visa-free entry to the Philippines, Indian nationals must:

-

Hold a passport valid for at least 6 months

-

Show proof of accommodation

-

Provide evidence of sufficient financial means

-

Present a return or onward ticket

-

Have no criminal record in the Philippines

🔒 Note:

Cannot be extended

Entry only for tourism

Cannot be converted into other visa types

Available at all major airports and seaports

4. Who Qualifies for 30-Day AJACSSUK Visa-Free Entry?

🛂 Eligibility:

You must be an Indian passport holder with a valid visa or residence permit from any AJACSSUK nation.

📑 Additional Requirements:

-

Proof of valid AJACSSUK visa/residency

-

Passport with 6+ months validity

-

Return or onward travel ticket

-

No previous criminal record in the Philippines

🚫 Note:

No extensions allowed

Only valid for tourism

Cannot be converted into other visa types

Valid at all primary entry points.

5. Philippines: A Tropical Tax Haven for Expats

One of the best-kept secrets of the Philippines is its favorable tax policy for foreigners:

💼 Who Pays Tax in the Philippines?

Only resident citizens are taxed on worldwide income. Everyone else—non-residents, expats, digital nomads—are taxed only on Philippine-sourced income.

🏝️ Meaning:

As an Indian digital nomad earning abroad, you may owe 0% tax on your income if you’re not a resident citizen.

6. Digital Nomad Visa in the Philippines – 2025 Launch

🌍 Digital Nomad Visa Highlights:

-

12-month initial validity

-

Renewable for another 12 months

-

No tax on foreign-sourced income

-

Proof of income (~$24,000/year) required

📈 Expected to rival similar offerings in Portugal, Estonia, and Thailand.

7. Best Visa Types for Long-Term Stay

Apart from visa-free entry and the digital nomad visa, consider:

🛬 Special Resident Retiree Visa (SRRV)

-

Previously allowed at age 35+

-

Now requires higher financial proof

💼 Special Investor’s Resident Visa (SIRV)

-

Invest $75,000+ in a business or securities

-

Offers indefinite residency

✅ Ideal for Indian HNIs, entrepreneurs, and long-term residents

8. Business and Investment Opportunities in the Philippines

The government is actively encouraging 100% foreign ownership in key industries like:

-

Healthcare

-

Finance & fintech

-

E-commerce

-

IT & BPO (Business Process Outsourcing)

📊 Fast Facts:

-

E-commerce expected to hit $21 billion by 2025

-

24/7 English-speaking support workforce

-

Access to regional ASEAN markets.

9. English Proficiency and Cultural Compatibility

Over 90% of Filipinos speak fluent English, making communication seamless for Indians.

-

All government documents and contracts are in English

-

Cultural values are friendly and community-oriented

-

Adaptation is easier compared to many other Asian nations

10. Top Expat Hotspots: Island Life and More

🌴 Top Locations for Expats:

-

Siargao: Surfing + growing expat community

-

Palawan: Ranked the best island in the world

-

Boracay: Tourism + nightlife hub

-

Cebu: Digital nomad & startup capital

-

Manila: Urban vibe with modern infrastructure

11. Cost of Living: How Affordable is the Philippines?

A modest budget of $1,200–$1,800/month can support a high-quality lifestyle:

| Expense Type | Average Monthly Cost |

|---|---|

| Rent (1BR apartment) | $300–$600 |

| Utilities + Internet | $60–$100 |

| Food & Groceries | $200–$300 |

| Local Transport | $30–$50 |

| Leisure & Dining | $150–$250 |

📉 Compare this with Singapore or Dubai, and you see the affordability edge.

12. Taxation Breakdown: How Foreigners Avoid Global Taxation

Philippines applies worldwide taxation only on resident citizens. Here’s a snapshot:

Tax Categories:

-

Resident Citizens – Taxed globally

-

Non-Resident Citizens – Local income only

-

Resident Aliens – Local income only

-

Non-Resident Aliens Engaged in Trade – Local income

-

Non-Resident Aliens Not Engaged in Trade – Local income

✅ If you’re a digital nomad or remote worker:

You’re likely a non-resident alien, meaning 0% tax on income earned outside the country.

13. Why the Philippines is the Next Big Thing for Indian Professionals

-

Easy access with visa-free entry

-

Affordable second home or retirement

-

Startup-friendly policies

-

Tax-friendly for digital professionals

-

Cultural proximity: Filipinos love Indian culture & food

14. Challenges to Be Aware Of

Before you book a one-way ticket, note:

-

Infrastructure issues in rural areas

-

Pollution and congestion in Metro Manila

-

Bureaucracy and legal red tape

-

Petty crime in urban centers

But with smart planning, many expats thrive here long-term.

15. Is the Philippines Right for You?

If you’re an Indian tourist, remote worker, or entrepreneur looking for a country with:

-

Visa-free access

-

English-speaking population

-

Tropical beauty and low taxes

-

Entrepreneurial and digital nomad incentives.

…then the Philippines should be at the top of your list in 2025.