Discover how to purchase gold jewellery without paying making charges using smart gold saving schemes from Joyalukkas and Malabar. Learn how to save thousands with these strategies. Learn how to save money and plan your jewellery purchases effectively in 2025.

Purchasing gold jewellery often comes with hefty making charges, sometimes ranging from 10% to 25% of the gold’s value. However, by leveraging specific gold saving schemes offered by reputed jewellers like Joyalukkas and Malabar Gold & Diamonds, you can effectively eliminate or significantly reduce these charges. Here’s how:

How to Buy Gold Jewellery Without Making Charges in India

Gold jewellery holds a special place in Indian culture, symbolizing wealth, tradition, and celebration. However, the additional making charges, often ranging from 8% to 20%, can significantly increase the cost of purchasing gold ornaments. Fortunately, several jewellers in India offer gold saving schemes that allow customers to buy jewellery with reduced or zero making charges. In this article, we’ll explore how you can leverage these schemes, particularly from Joyalukkas and Malabar Gold & Diamonds, to make smart and cost-effective gold purchases in 2025.

Understanding Making Charges

Making charges are fees levied by jewellers to cover the cost of designing and manufacturing gold jewellery. These charges are usually calculated as a percentage of the gold’s weight and can vary based on the complexity of the design and the jeweller’s pricing policies. While these charges are standard in the industry, they can be a significant expense for buyers.

Gold Saving Schemes: A Smart Way to Save

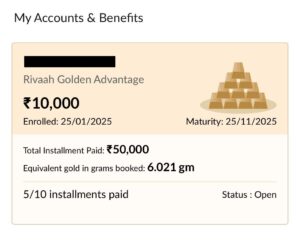

Gold saving schemes are structured plans offered by jewellers that allow customers to invest a fixed amount regularly over a specified period. At the end of the tenure, customers can purchase gold jewellery equivalent to the accumulated amount, often with benefits like discounts on making charges or additional bonuses. These schemes are particularly beneficial for individuals planning significant purchases, such as wedding jewellery, as they promote disciplined savings and offer cost advantages.

Joyalukkas Easy Gold Scheme

Joyalukkas, a renowned jewellery brand in India, offers the Easy Gold Scheme designed to make gold purchases more affordable. Make fixed monthly installments, starting from ₹1,000, for a tenure of 10 months.

Key Features:

-

Flexible Tenure: Customers can choose a tenure that suits their financial planning.

-

Monthly Installments: Invest a fixed amount monthly, starting from as low as ₹1,000.

-

Zero Making Charges: Enjoy up to 18% waiver on making charges for gold, silver jewellery, coins, and bars.

-

Diamond Jewellery Benefits: Avail up to 50% off on making charges for diamond jewellery.

-

Easy Redemption: At the end of the scheme, redeem your savings to purchase jewellery of your choice.

-

Enrollment: Available online through the Joyalukkas website or app.

This scheme is ideal for customers looking to plan their jewellery purchases in advance while enjoying significant savings on making charges.

Malabar Gold & Diamonds: Golden Bloom and Golden Glow Plans

Malabar Gold & Diamonds offers two distinct gold saving schemes catering to different customer needs:

Golden Bloom Plan

Highlights:

-

Fixed Monthly Payments: Invest a fixed amount monthly for 11 months.

-

Zero Making Charges: Upon completion, enjoy up to 18% waiver on making charges for selected jewellery.

-

Prevailing Gold Rate: Purchase jewellery at the gold rate prevailing at the time of redemption.

This plan is suitable for customers who prefer structured savings with the benefit of zero making charges at the end of the tenure.

Golden Glow Plan

Highlights:

-

Flexible Payments: Invest any amount at any time during the scheme period.

-

Gold Accumulation: Gold is credited based on the prevailing rate on the day of each investment.

-

Zero Making Charges: Enjoy up to 14% waiver on making charges when redeeming accumulated gold.

-

Smart Averaging: By investing over time, customers can average out the cost of gold, mitigating the impact of price volatility.

The Golden Glow Plan offers flexibility and is ideal for customers who prefer to invest varying amounts based on their financial convenience.

Tanishq Golden Harvest Scheme

Tanishq, another prominent jewellery brand, offers the Golden Harvest Scheme, allowing customers to save systematically for their jewellery purchases.

Key Features:

-

Tenure: 10 months of regular monthly payments.

-

Minimum Investment: Start with as low as ₹2,000 per month.

-

Bonus: Upon maturity, receive a special discount equivalent to 75% of the first month’s instalment.

-

Jewellery Purchase: Redeem the accumulated amount to purchase jewellery of your choice.

This scheme is beneficial for customers planning ahead for significant jewellery purchases, offering both savings and bonuses.

Benefits of Gold Saving Schemes

-

Cost Savings: Significant reductions or waivers on making charges.

-

Disciplined Savings: Encourages regular savings towards a specific goal.

-

Price Averaging: Mitigates the impact of gold price volatility by spreading purchases over time.

-

Flexible Investment: Options to choose fixed or flexible investment amounts based on personal financial planning.

-

Planned Purchases: Ideal for planning jewellery purchases for weddings, festivals, or other significant events.

Important Considerations

-

Terms and Conditions: Carefully read and understand the terms of the scheme, including any penalties for missed payments or early withdrawals.

-

Jewellery Selection: Some schemes may have restrictions on the types of jewellery that can be purchased upon redemption.

-

Refund Policies: Understand the refund policies in case you decide not to purchase jewellery at the end of the scheme.

-

Authenticity: Ensure that the jeweller provides certified and hallmarked jewellery to guarantee purity and authenticity.

-

Reputation of Jeweller: Ensure you’re dealing with reputed jewellers to avoid potential scams.

-

Tax Implications: While discounts on making charges are generally not taxable, any additional benefits or cashbacks should be evaluated for tax liabilities.

Gold saving schemes offered by reputed jewellers like Joyalukkas and Malabar Gold & Diamonds provide an excellent opportunity to plan and purchase gold jewellery without the burden of making charges. By understanding the features and benefits of each scheme, you can choose the one that aligns best with your financial goals and jewellery preferences. Start investing today to make your future gold purchases more affordable and stress-free.

Disclaimer: The information provided in this article is based on publicly available sources and is for informational purposes only. Please consult with the respective jewellers or financial advisors before enrolling in any gold saving scheme.

Officials have advised the public to be cautious of unsolicited offers of gold or investments, particularly those creating urgency and requesting confidential transactions. Victims of cyber fraud are urged to seek help by dialling 1930 or visiting cybercrime.gov.in.

Gold Schemes Caution:

₹100 crore scam by Pranav Jewellers in Tamil Nadu. Pranav Jewellers asked people to in their Gold Saving Scheme with monthly/yearly investment scheme.

The Torres Jewellery scam in Mumbai involved a Ponzi scheme that defrauded 1.25 lakh investors of over Rs 1,000 crores.