How to choose your basket of tax-saving allowances 👇

👤 Old Regime or New? And which allowances to pick?

A fresh financial year kicks off! 🎉

Time to make a choice—

will you stick with the old tax regime or switch to the new one? 💰💭

With FY 2024-25 closing soon, it’s decision time! Should you stick with the Old Tax Regime or switch to the New one? 📊🔍

Swipe 👉 to break it down & make the best choice for your finances!

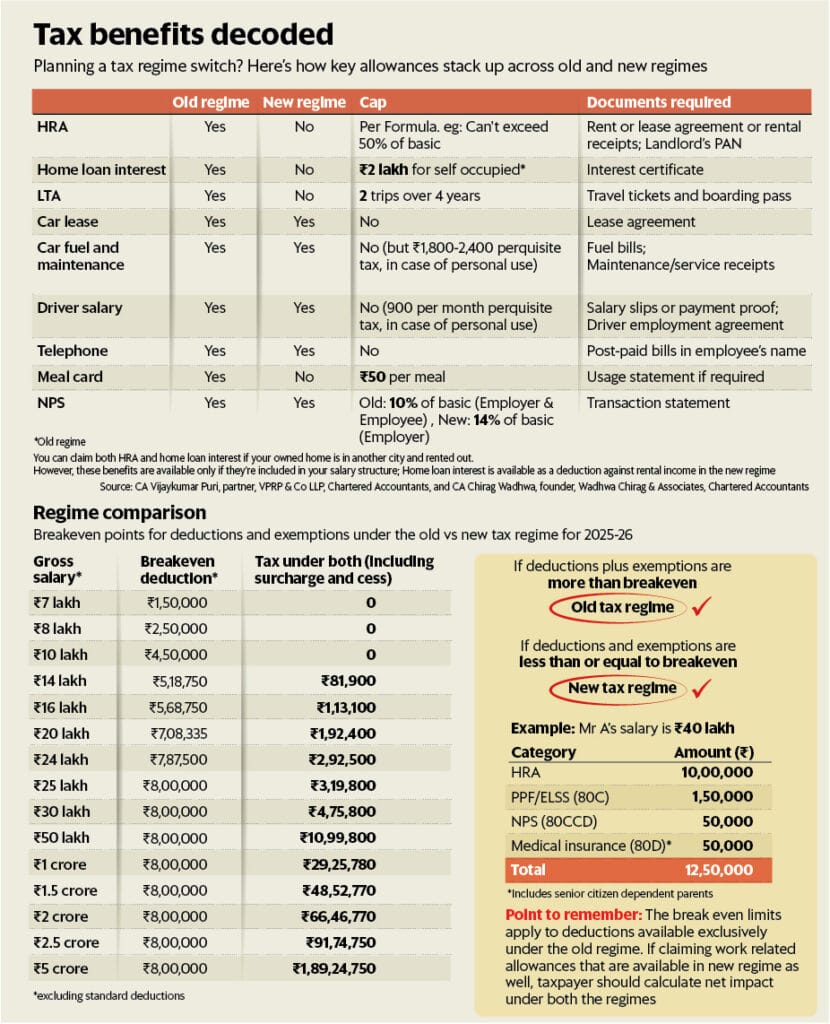

. Unless you have huge HRA/Home Loan Interest, stick to the new tax regime

All allowances need proof.

(Note: Corrected earlier error about meal coupons. Not there in new regime)

Driver salary and Fuel/Vehicle maintenance are available in new regime. (these are reimbursements, not considered part of salary)

The only reason car payments are considered reimbursement is because every IRS officer gets up 50k per month for leased car and driver. Perk value is low for private use because most use of these cars are for private purpose.

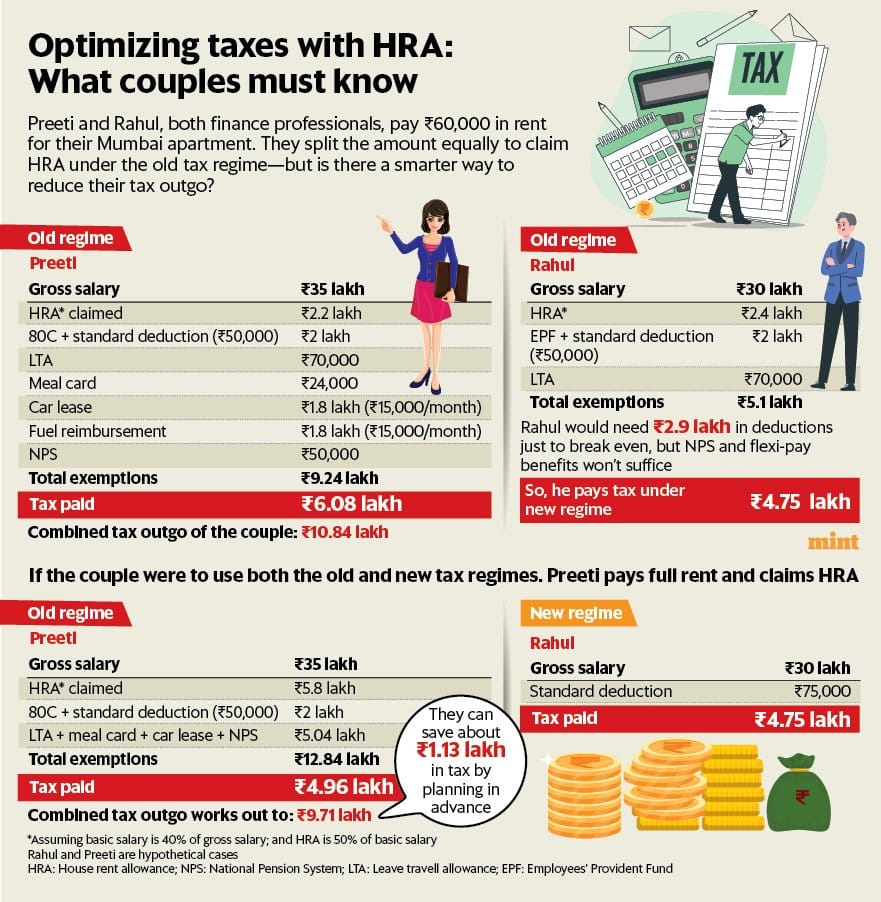

the threshold of deductions to be better off in the old regime has been raised, couples can do some smart tax planning. Load all the deductions & HRA with one spouse. Other one goes into new regime. Both better off.

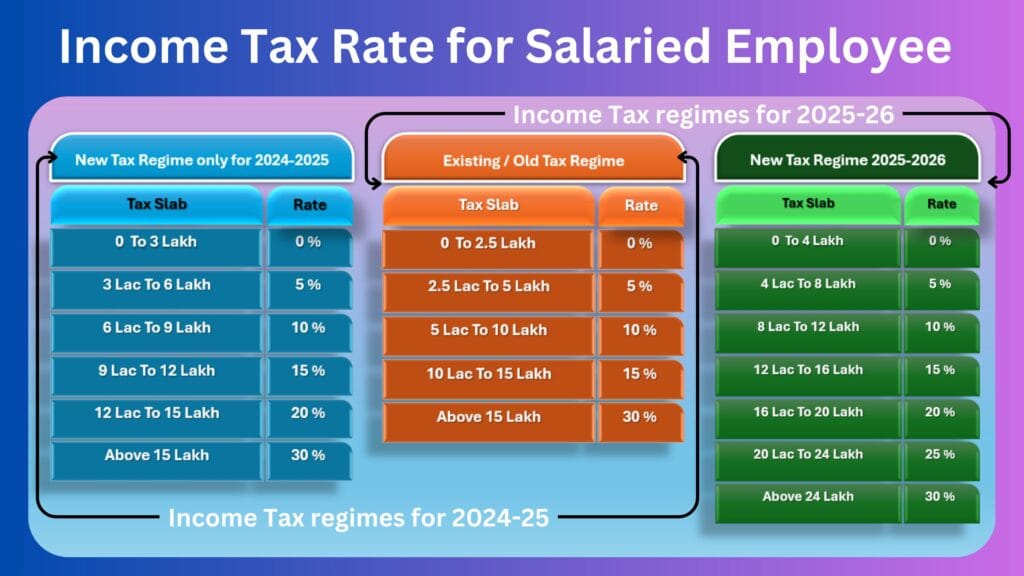

🚨 New Income Tax 2025🚨

📉 0% ➡️ Up to ₹4L

💰 5% ➡️ ₹4L – ₹8L

📊 10% ➡️ ₹8L – ₹12L

📈 15% ➡️ ₹12L – ₹16L

📊 20% ➡️ ₹16L – ₹20L

📈 25% ➡️ ₹20L – ₹24L

💸 30% ➡️ ₹24L & Above

⚡ No tax if income is below ₹12L!

❌ Nothing for the old tax regime.

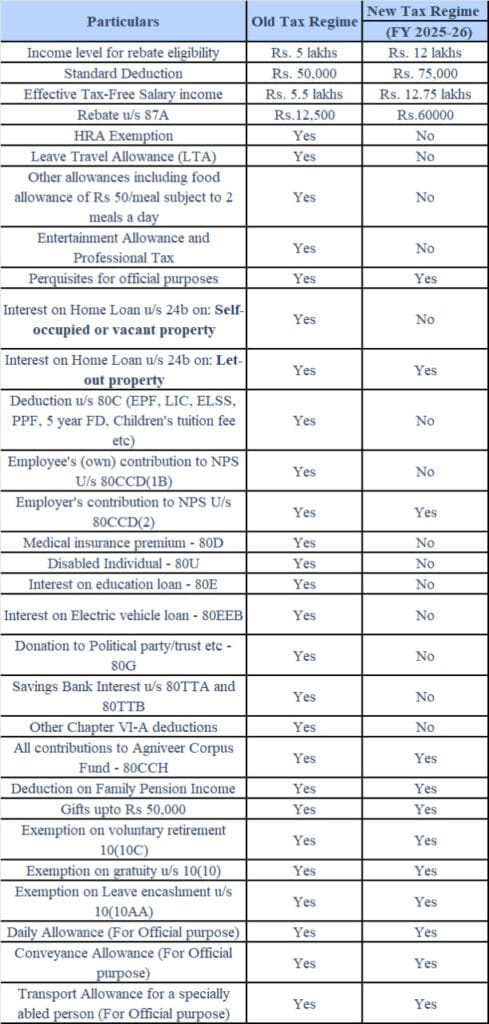

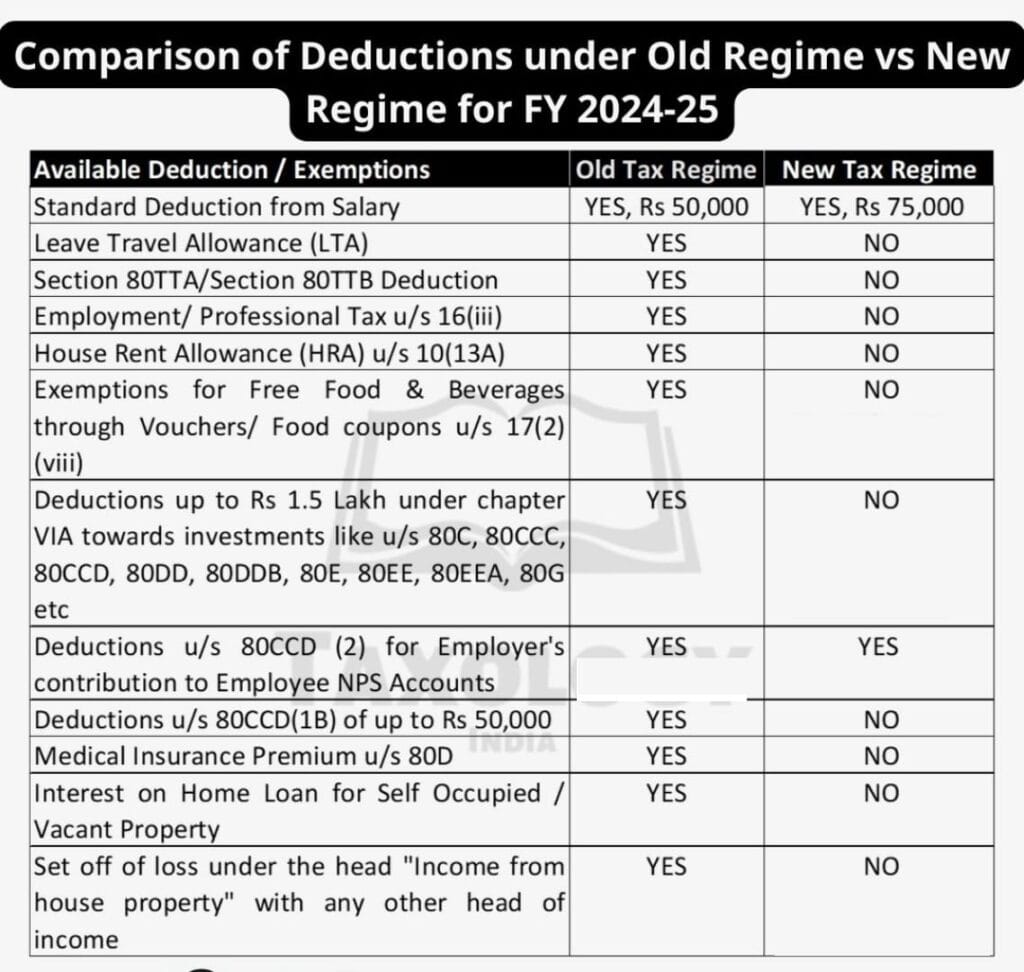

Tax Regimes for Salaried Employees (2024-25 & 2025-26) – Which one’s better for YOU? 💼💰

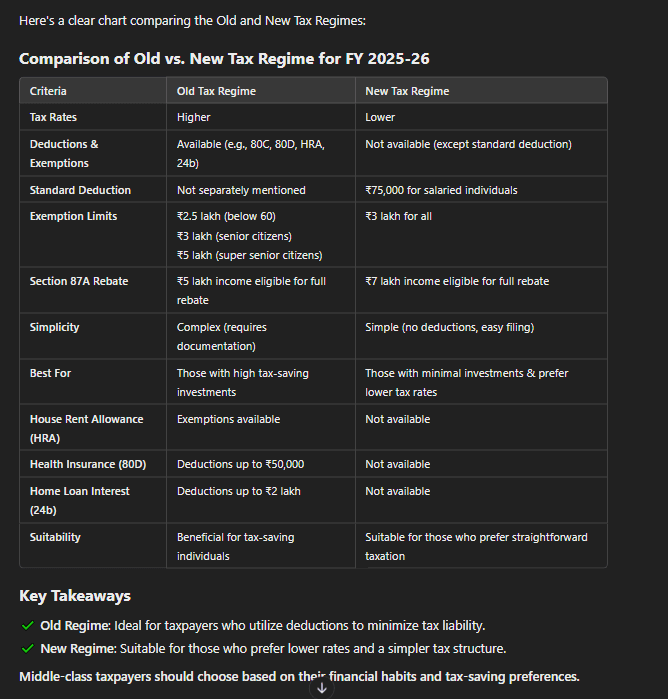

✅ Old Tax Regime: Deductions under 80C, HRA, LTA, etc.

✅ New Tax Regime: Lower tax rates but fewer benefits.

Choose wisely and save more! 💸

SHARE to help others! 🔄

Choosing Old or New Tax Regime for FY 25-26: Time to declare to employer | Choose wisely for Lower TDS

Tax Regime Comparison (2025–26): Old Regime vs New Regime — What You Can & Can’t Claim

Applies to salaried individuals claiming HRA and paying high rent. Deduction allowed under Section 10(13A) only if landlord’s PAN is provided.

Join my Community for Daily Pharma & Software Jobs and Fully funded MS & PhD admissions Updates👇🏻

📌 Telegram: https://t.me/thenewfueldata

📌 WhatsApp: https://whatsapp.com/channel/0029Vb5Rwws3AzNMWJIRDj3G

📌 facebook: https://www.facebook.com/new.fuel.data

📌 Instagram: https://www.instagram.com/thenewfueldata/

Follow https://thenewfueldata.in/ for more opportunities. I am just helping job seekers!

🔄 Comment | Refer | Tag & Share to help someone land the right opportunity! 🚀