Trump’s Tariff Tantrum? India’s Market Shrugs It Off!

Trump just hit Indian goods with a 26% tariff, but guess what? Nifty barely flinched (-80 pts), while US markets tanked (DOW Jones -1,200 pts). Why? India’s economic engine is too strong to stall!

Domestic demand cushions the blow

IT & Pharma remain global powerhouses

RBI’s liquidity push = Bull run ahead Yes, ESM might tap the brakes, but it can’t stop this momentum. Buckle up—Nifty’s next move could be historic!

U.S. imposes a 26% tariff on Indian goods ! Key sectors likely hardest hit: textiles, pharmaceuticals, and IT services. This imbalance could impact

exports significantly. Should India push for fairer trade terms?

China: 34 % (charges US 67 %)

Taiwan: 32 % (charges US 64 %)

India: 26 % (charges US 52 %)

European Union: 20 % (charges US 39 %)

Nigeria: 14 % (charges US 27 %)

Egypt: 10 % (charges US 10 %)

UAE: 10 % (charges US 10 %)

Mexico – Nil

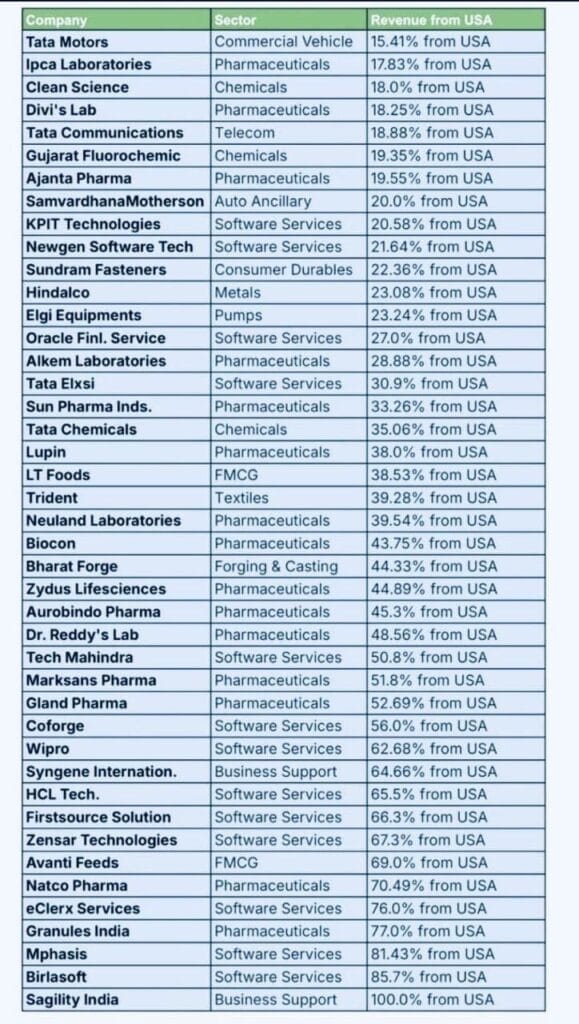

INDIAN COMPANIES AND THEIR US BUSINESS EXPOSURE

Tata motors to pause exports to US

Major Impcat to be seen on Tata motors

Trading at 613 and the way this news came now

The Reciprocal Tariffs Have Been Announced!

Trump’s boldest trade move yet — here’s the updated tariff chart:

Country-wise Tariff Rates:

🇨🇳 China – 34%

🇪🇺 EU – 20%

🇨🇭 Switzerland – 31%

🇻🇳 Vietnam – 46%

🇹🇼 Taiwan – 32%

🇯🇵 Japan – 24%

🇮🇳 India – 26%

🇰🇷 South Korea – 25%

🇹🇭 Thailand – 36%

🇰🇭 Cambodia – 49%

🇬🇧 UK – 10%

🇧🇩 Bangladesh – 37%

🇲🇾 Malaysia – 24%

🇿🇦 South Africa – 30%

🇵🇭 Philippines – 17%

🇮🇱 Israel – 17%

🇵🇰 Pakistan – 29%

🇱🇰 Sri Lanka – 44%

➤ Minimum baseline tariff of 10% on all other countries.

➤ Tariffs effective from April 5, sharper hikes from April 9.

10% tariff on all nations from April 5

26% tariff on India from April 9

Exemptions: Steel, auto parts, copper, pharma, semiconductors & minerals

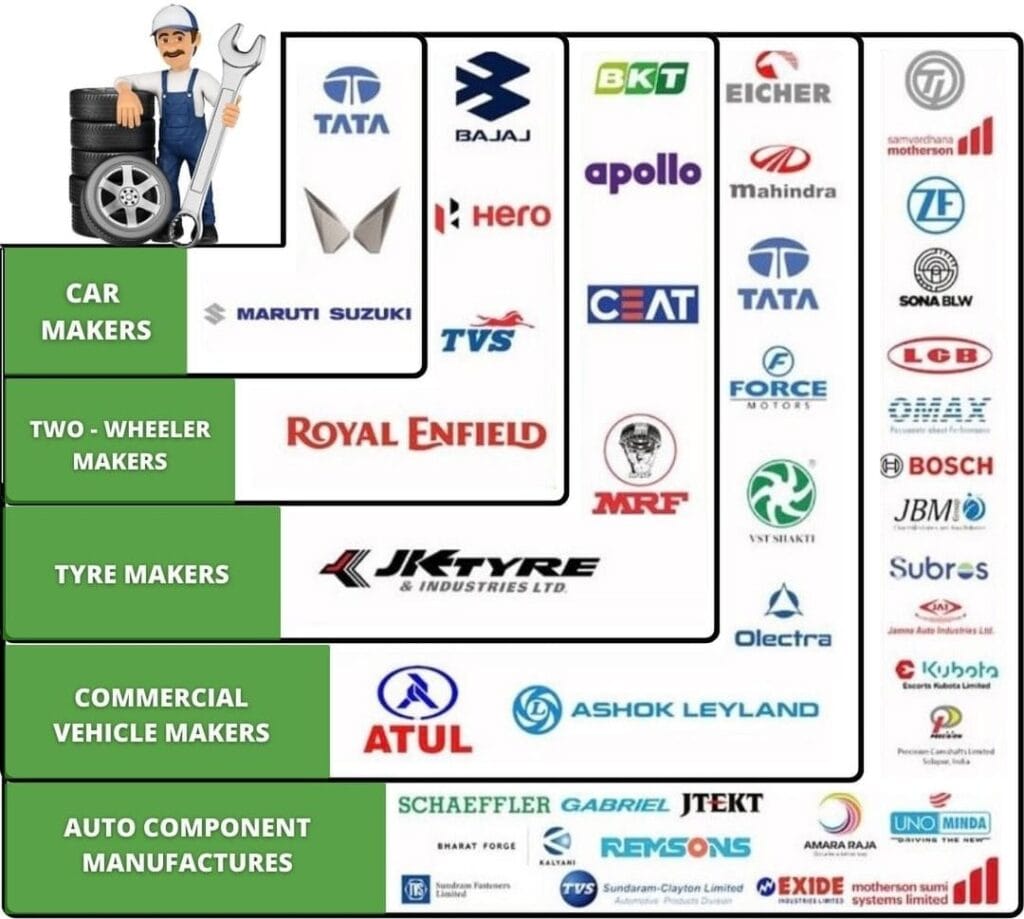

Automobile sector has taken centre stage recently after Donald Trump announced tariffs of 25% on cars imported from India.

Top Indian Auto Stocks :

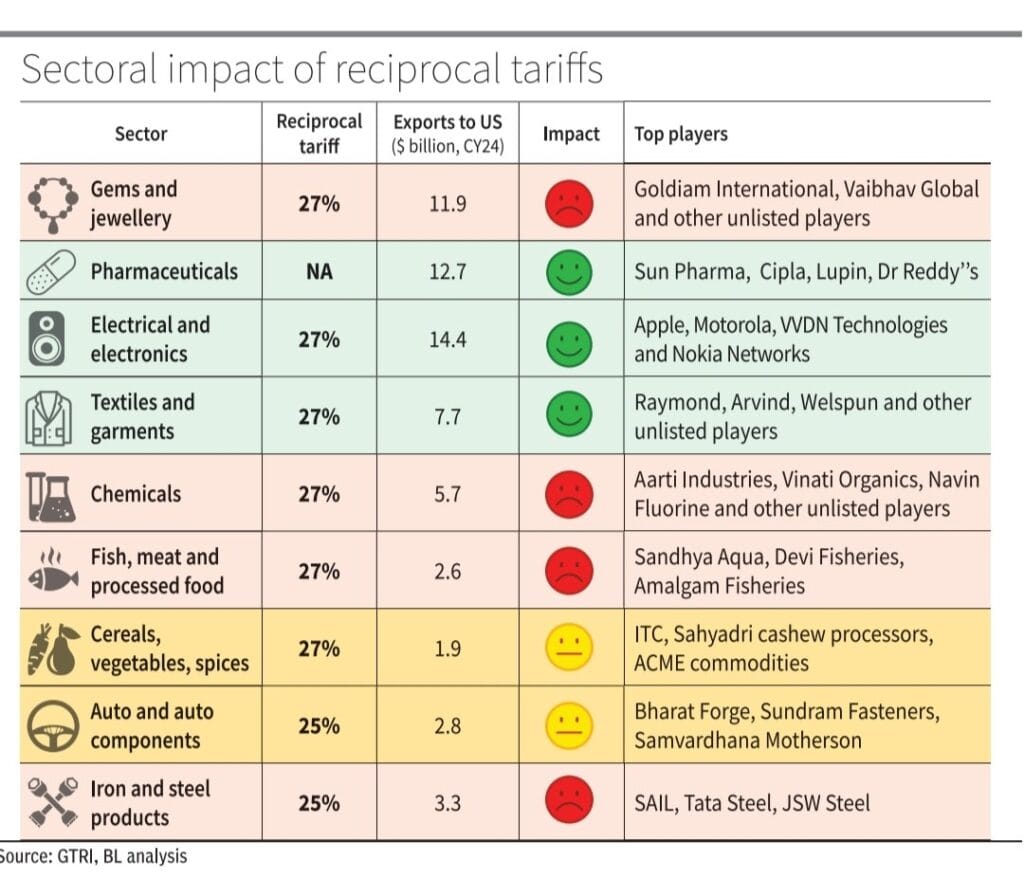

Tariff impact – Indian sectors & stocks

Sector-wise snapshot of US Tariffs on India

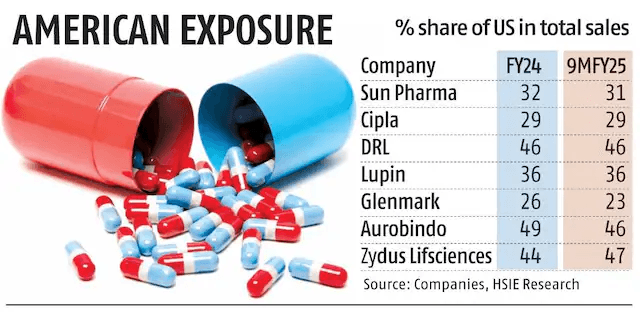

Positive

– Pharma

– Aquaculture

– Manmade textile

Negative

– Chemicals

– Woolen/Cotton Textile

– Metals

– Technology

– Gems and Jewelry

– Electricals

– Capital goods (Auto, Auto Ancillaries and Metals tariffs already announced)